Parametric protection: covering the insurance gap

Bespoke parametric insurance protection against bushfire and loss of carbon credits.

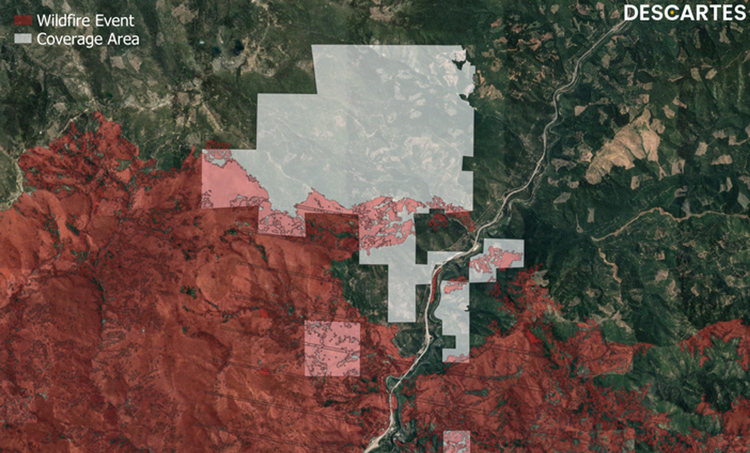

An example visualisation of Descartes bushfire product live in action on a New South Wales plantation. Image: Descartes

MAIN PIC: Australia is facing growing wildfire risks, driving insurance premiums and deductibles higher and in some cases eliminating wildfire coverage altogether. Image: Adobe Stock/Descartes

Australia is no stranger to the devastating impact of wildfires, but with shifting climate patterns and lengthening fire seasons, the stakes are rising rapidly.

From the catastrophic Black Summer of 2019-2020, which scorched more than 24 million hectares and triggered $2.4 billion in insured losses, to increasing fire risk across South Australia and Victoria, the frequency and severity of wildfire events are reaching critical levels.

As traditional insurance models struggle to keep pace, parametric insurance is emerging as a smarter, data-driven alternative. With rapid payouts triggered by predefined conditions, parametric solutions offer transparency, speed and the financial resilience needed to navigate an increasingly volatile wildfire landscape.

“Between September and December in Australia is peak exposure time, so now is the time to review and secure parametric wildfire insurance to be prepared for the season ahead,” Lynn Roehrig, Descartes Head of Business Development Australia and New Zealand said.

Descartes’ parametric solutions offer a new form of resilience to wildfire. Customised precisely to clients’ exposure based on up-to-date plantation shapefile and valuation, Descartes covers the entire risk season with a straight-forward, transparent satellite-based solution.

SEASON FORECAST

Wildfire is one of the most significant natural hazard risks in Australia. While the danger period typically spans summer and autumn across most of southern Australia, the timing varies by region. In New South Wales and southern Queensland, peak fire risk usually occurs in spring and early summer, whereas the Northern Territory experiences the bulk of its wildfires during winter and spring.

This year, ongoing dry conditions in South Australia and Victoria saw fire risk in those regions elevate earlier than usual, exacerbated by higher-than-average atmospheric pressure over southern Australia – part of a broader climatic shift linked to climate change.

“The increasing scale and complexity of wildfires across Australia and New Zealand are threatening more than just the land – they’re impacting critical carbon credit investments and leaving plantation assets dangerously exposed,” Lynn said.

CLOSING THE INSURANCE GAP

Australia’s insurance industry has paid out billions in claims from recent wildfire events, prompting a natural tightening of the market. Brokers are now reporting reduced capacity, with many policies either excluding wildfire risk altogether or imposing strict limitations.

This shift is being driven by compounded losses and rising costs in the reinsurance market for wildfire coverage, leaving policyholders facing higher premiums, increased deductibles, and severe sub-limits for wildfire-related claims.

In response, alternative risk transfer solutions are gaining traction – particularly parametric insurance. Descartes policies are tailored to the client’s specific exposure and rely on robust datasets including historical wildfire records, long-term climate trends, weather patterns and satellite imagery.

By using satellite technology to detect burnt areas and assess fire severity, Descartes parametric insurance offers full transparency. Clients know exactly what to expect in terms of payout, without exclusions for smaller fire events or delays in claims processing.

“Our Burnt Area product is a fully customisable solution that provides flexible structuring to match each client’s needs and budget,” Lynn said.

“With the use of satellite data, it is fully scalable across any area, meaning no on-site visit is required. Following a wildfire event, we deploy satellite imagery to identify the areas burned in and around the coverage area to determine if the policy has been triggered. Collaborating with third-party agencies ensures a high level of transparency and rigorous assessments.

“Our wildfire cover provides peace of mind to plantation owners and carbon investors, ensuring that even in the face of increasing climate volatility, their assets and income potential remain protected.”